Introduction – New Income Tax Bill 2025

The New Income Tax Bill 2025 was passed in the Lok Sabha on Monday, introducing significant reforms to India’s tax framework. Replacing the six-decade-old Income Tax Act, 1961, this landmark legislation simplifies tax laws, reduces litigation, and makes compliance easier for individuals and businesses alike. Finance Minister Nirmala Sitharaman reintroduced the New Income Tax Bill 2025 after incorporating over 285 recommendations from the Lok Sabha Select Committee.

Background of the New Income Tax Bill 2025

Initially introduced during the 2025 Budget session, the bill was sent to the Select Committee for review. The revised draft addresses stakeholder suggestions, improves clarity in legal language, and aligns the law with the needs of India’s growing digital economy.

The bill also coincides with the Taxation Laws (Amendment) Bill, which grants tax exemptions to Unified Pension Scheme subscribers. Both bills were passed without debate despite opposition protests.

Why the New Income Tax Bill 2025 Was Needed

The Income Tax Act, 1961, while robust, had become overly complex over time. Its language and structure often created confusion for taxpayers. The New Income Tax Bill 2025 aims to replace outdated provisions, remove contradictions, and present a cleaner, more modern tax framework.

Key structural updates include:

- 536 sections and 16 schedules arranged systematically.

- A single “Tax Year” concept replacing “Previous Year” and “Assessment Year.”

- Removal of unnecessary provisions to cut litigation.

- More powers to CBDT for rule-making in the digital era.

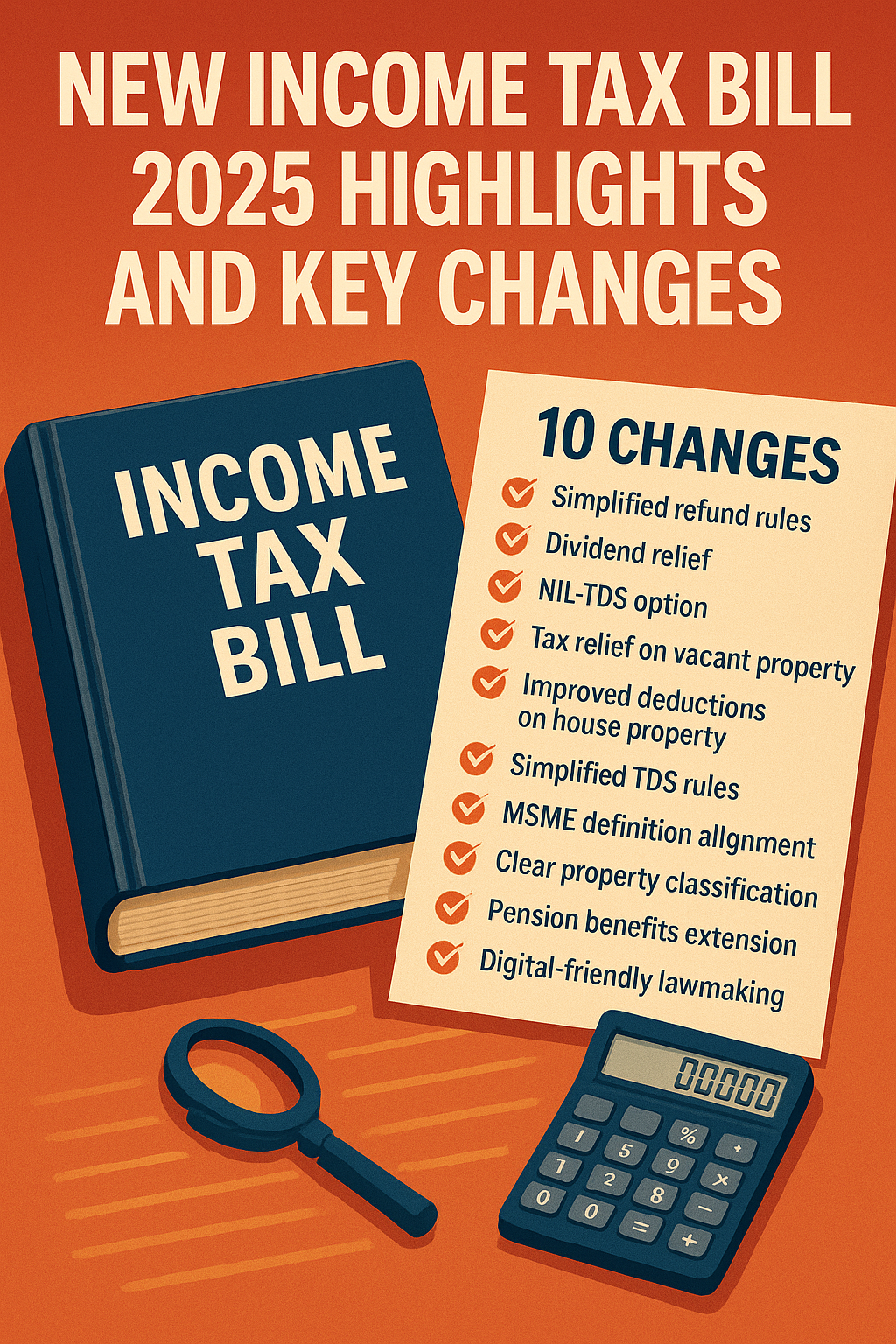

Top 10 Key Changes in the New Income Tax Bill 2025

1. Simplified Refund Rules

Even taxpayers filing returns late will now be eligible for refunds under certain conditions.

2. Dividend Relief

Reintroduction of an ₹80M deduction on inter-corporate dividends.

3. NIL-TDS Option

Taxpayers with no liability can apply for advance NIL-TDS certificates.

4. Tax Relief on Vacant Property

Removal of notional rent taxation on vacant houses.

5. Improved Deductions on House Property

30% standard deduction after municipal taxes and interest deduction on rented property maintained.

6. Simplified TDS Rules

Clarity on TDS for PF withdrawals, advance ruling fees, and penalties.

7. MSME Definition Alignment

MSME definition harmonized with the MSME Act.

8. Clear Property Classification

Replaced ambiguous terms to avoid misclassification.

9. Pension Benefits Extension

Non-employee individuals can now claim commuted pension deductions.

10. Digital-Friendly Lawmaking

CBDT empowered to adapt rules for modern business realities.

Comparison: Income Tax Act 1961 vs. New Income Tax Bill 2025

The 1961 law was heavily detailed but often repetitive. The New Income Tax Bill 2025 condenses, clarifies, and organizes rules to improve taxpayer understanding. It’s designed for both paperless compliance and evolving tax needs in a tech-driven economy.

Expert Opinions on the New Income Tax Bill 2025

Rajesh Gandhi, Partner at Deloitte India, calls the bill “more structured and concise,” particularly in its approach to foreign pension fund taxation.

Dinesh Kanabar, CEO of Dhruva Advisors, highlights the removal of Alternate Minimum Tax on LLPs, relaxation of rules for charitable trusts, and easing of Transfer Pricing provisions.

Impact on Taxpayers

The New Income Tax Bill 2025 is expected to:

- Reduce compliance burdens.

- Speed up refunds.

- Encourage investment in infrastructure.

- Improve ease of doing business in India.